I have an economics question that I can't seem to figure out... dunno if it's from doing fifty other questions or what.

If there is a deadweight loss caused by a tax that is used to provide a public good is greater than the efficiency gain that is achieved by having that public good then...

the public good should be provided in another way or not provided at all.

the tax should be used to offset inelastic demand.

the demand must be very elastic.

the supply must be very elastic.

Anyone have an answer and why?

Economics Question

Is this econ 1000? I knew how to do this last year but my memory tends to wipe fresh with each passing semester. best of luck

That is the whole question.

Q: If there is a deadweight loss caused by a tax that is used to provide a public good is greater than the efficiency gain that is achieved by having that public good then...

A. the public good should be provided in another way or not provided at all.

B. the tax should be used to offset inelastic demand.

C. the demand must be very elastic.

D. the supply must be very elastic.

" That is the whole question. Q: If there is a deadweight loss caused by a tax that is used to provide a public good is greater than the efficiency gain that is achieved by having that public good then... A. the public good should be provided in another way or not provided at all. B. the tax should be used to offset inelastic demand. C. the demand must be very elastic. D. the supply must be very elastic. "E. Economics is a pseudo-science.

" @MrKart said:That was my first guess as well. Stupid multiple choice." That is the whole question. Q: If there is a deadweight loss caused by a tax that is used to provide a public good is greater than the efficiency gain that is achieved by having that public good then... A. the public good should be provided in another way or not provided at all. B. the tax should be used to offset inelastic demand. C. the demand must be very elastic. D. the supply must be very elastic. "E. Economics is a pseudo-science. "

" Is this econ 1000? I knew how to do this last year but my memory tends to wipe fresh with each passing semester. best of luck "As true of testament to the practical importance of an expensive college education as I've seen.

Elasticity should have nothing to do with this which is just the sensitivity of supply or demand with respect to changes in price, which is formally f (q,) - f (q ,,) / q, - q,, or dp/dq or just the slope of the curve" I have an economics question that I can't seem to figure out... dunno if it's from doing fifty other questions or what. If there is a deadweight loss caused by a tax that is used to provide a public good is greater than the efficiency gain that is achieved by having that public good then... the public good should be provided in another way or not provided at all.the tax should be used to offset inelastic demand.the demand must be very elastic.the supply must be very elastic. Anyone have an answer and why? "

So B, C, D don't work because the question has nothing to do with sensitivity to changes in price.

And if the DWL is greater than the efficiency gained, then economically that public good should not be provided for in that way because the net consumer/producer surplus is less when it is provided in that way. Remember, in microeconomics, the main goal is to maximize consumer and producer surplus. DWL is the negation of any surplus of all parties so it is to be avoided at all costs.

Elasticity should have nothing to do with this which is just the sensitivity of supply or demand with respect to changes in price, which is formally f (q,) - f (q ,,) / q, - q,, or dp/dq or just the slope of the curve So B, C, D don't work because the question has nothing to do with sensitivity to changes in price. And if the DWL is greater than the efficiency gained, then economically that public good should not be provided for in that way because the net consumer/producer surplus is less when it is provided in that way. Remember, in microeconomics, the main goal is to maximize consumer and producer surplus. DWL is the negation of any surplus of all parties so it is to be avoided at all costs. "

When I first read the question properly, instantly I kind of knew it was Answer A but it was one of those nagging feelings in the back of my head, through forgetting so much of basic economics, that the answer is just too obvious. It makes perfect sense that if the negative loss to society, i.e. the deadweight is larger than the gain, i.e. the efficiency, then surely you would scrap the whole scheme altogether.

But surely the elasticity of prices does affect the amount of consumption of that product. The price adjusted in an elastic demand curve would have a far larger impact than in an inelastic demand. In this respect the tax represents a PRICE INCREASE? No? That tax is borne by both the supplier and consumer.

N.B. I previously posted that Answer C was incorrect, but I may have been mistaken. An elastic demand curve would produce a larger deadweight loss area than an inelastic one, since the changes in price would affect the quantity consumed to a greater degree. Therefore any interference in the market and raising of prices WOULD affect the amount of people who buy the product to a high degree.

Answer should be A.

The question is not talking about price, so B, C and D (elasticity --> price elasticity) can be ruled out. Offsetting inelastic demand with taxes also makes no sense. When a policy is imposed that brings greater negatives (deadweight loss) than positives (efficiency gain), then it is a net negative, and therefore the original state would be better than the state post-policy.

At least, that's the most straightforward answer.

It could possibly be referring to something like this though, but that seems kind of a stretch for a first year ECON course:

http://www.basiceconomics.info/tax-and-deadweight-loss.php

Determinants of Deadweight Loss

How large will the deadweight loss be from a particular tax? It depends on how much a given tax reduces the amount that:

- consumers are willing to purchase and;

- producers are willing to supply.

What determines how much the market will shrink? Reduction in quantity supplied as a result of a tax depends on the elasticity of supply. Generally, the more inelastic the supply, the smaller the reduction in quantity, and the smaller the deadweight loss. Reduction in quantity demanded depends on the elasticity of demand. Generally, the more elastic the demand, the more quantity demanded decreases and the greater the deadweight loss.

In general, the smaller the decrease in quantity, the smaller the deadweight loss. This occurs since the main cost of a tax is that it shrinks the size of a market below its optimum level. Overall, the more elastic the supply and demand, the larger the dead weight loss of a tax." @lilburtonboy7489 said:You are right actually, it could be C. I drew the following is MS Paint, give me a break. This is an excise tax on a good.Elasticity should have nothing to do with this which is just the sensitivity of supply or demand with respect to changes in price, which is formally f (q,) - f (q ,,) / q, - q,, or dp/dq or just the slope of the curve So B, C, D don't work because the question has nothing to do with sensitivity to changes in price. And if the DWL is greater than the efficiency gained, then economically that public good should not be provided for in that way because the net consumer/producer surplus is less when it is provided in that way. Remember, in microeconomics, the main goal is to maximize consumer and producer surplus. DWL is the negation of any surplus of all parties so it is to be avoided at all costs. "

When I first read the question properly, instantly I kind of knew it was Answer A but it was one of those nagging feelings in the back of my head, through forgetting so much of basic economics, that the answer is just too obvious. It makes perfect sense that if the negative loss to society, i.e. the deadweight is larger than the gain, i.e. the efficiency, then surely you would scrap the whole scheme altogether.

But surely the elasticity of prices does affect the amount of consumption of that product. The price adjusted in an elastic demand curve would have a far larger impact than in an inelastic demand. In this respect the tax represents a PRICE INCREASE? No? That tax is borne by both the supplier and consumer.

N.B. I previously posted that Answer C was incorrect, but I may have been mistaken. An elastic demand curve would produce a larger deadweight loss area than an inelastic one, since the changes in price would affect the quantity consumed to a greater degree. Therefore any interference in the market and raising of prices WOULD affect the amount of people who buy the product to a high degree.

"

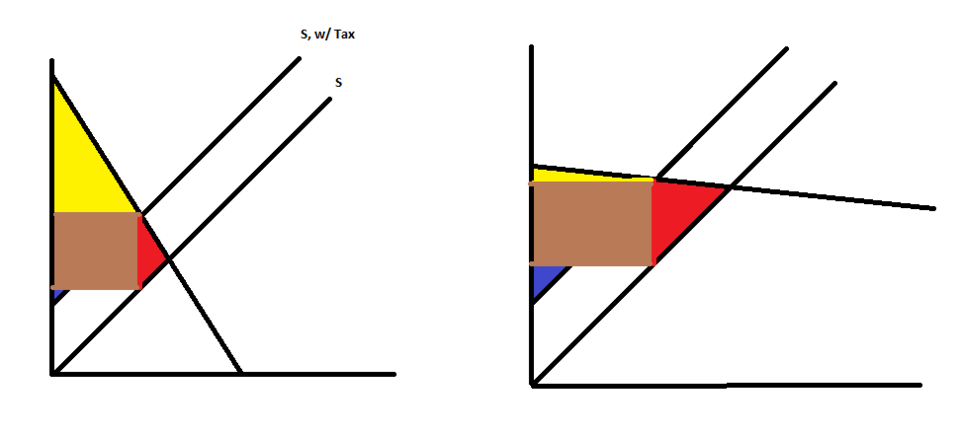

Blue: Producer Surplus

Poop: Government Revenue

Red: Deadweight Loss

As you can see, as the slope becomes smaller for the demand curve (ie. Demand curve is very elastic), the amount of DWL increases. So C would actually appear correct...in a micro course. Of course, as the demand curve becomes more elastic, the government revenue increases as well, allowing larger G in the equation Y = C + I + G + NX. So even while I (possible inventory investment) or C will drop, G will increase. So in the macro sense, this situation is not necessarily bad. But since you are talking about DWL, you are in micro, so C is probably the right answer.

Please Log In to post.

Log in to comment