I recently did my taxes on Turbo Tax for the first time. I have never done my taxes before and when I told people that I owed federal a chunk of money they were surprised. So I feel that I might be doing something wrong. I am 21, a full-time student at my local university, I have two jobs that together give me roughly 20-hours a week. I recently got my1098_T after already sending out my taxes. My friends said that it would be stupid for me not to include the 1098 form as I'd be missing out on money. So I added it and it turned out that I owed federal even more money. What am I doing wrong? On one of my W-2's I have $0.51 Federal Income Tax withheld. Is that bad? Any help from you smarter duders would be greatly appreciated.

I don't understand taxes.

If you only had $0.51 withheld from your paychecks, it's not too surprising that you would owe some money. How many allowances did you claim on your W-4? I suspect that might be where you messed up.

I also don't really understand how entering in your tuition info could make it go up. I've never heard of that happening for anyone.

Yeah, that is probably why I owe money. My 1098 form showed all of the financial aid that I received so maybe that is why it went up?

I got a refund check from the university so I think that is why my taxes went up when I added that form.

This is all gibberish to me, I am going to have a lot of trouble figuring all this out when I can finally start getting steady income and not have to rely so much on my parents...

@cmpltnoob: Yeah. Taxes are no fun. lol

@aegon: I think it took me about an hour and a half. You are basically just copying things from the W-2 forms you get from work.

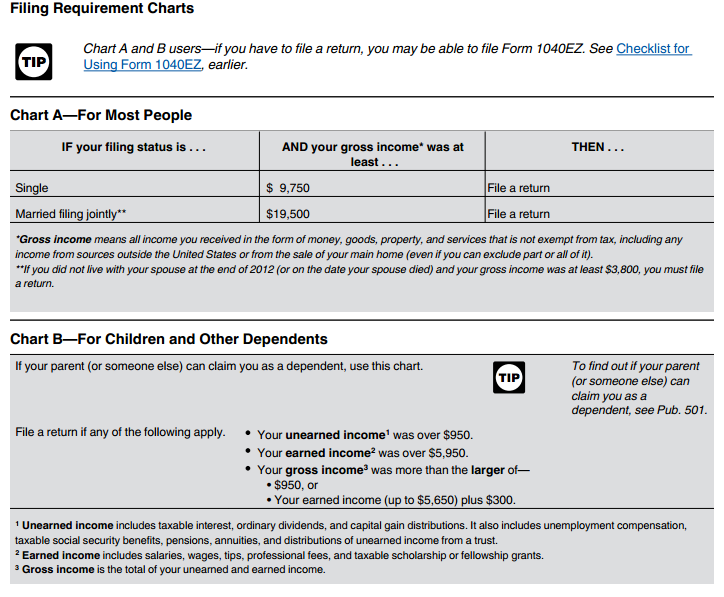

I would advise just doing the free online fillable forms version of the 1040EZ. I don't think your situation is complex enough to warrant paying anyone to do it for you or getting fleeced out of $10 by TurboTax. I'm guessing you wen't over the $9750 mark and do need to file, but the document below tells you everything you need to know. Not witholding anything isn't a bad thing. It just means there is nothing the government is holding that you could get back.

They have step by step instructions:

http://www.irs.gov/pub/irs-pdf/i1040ez.pdf

If you are going to college you should be able to handle it. It really isn't that confusing. Next year do it yourself I think you will agree it's not that bad.

I was coming in to this forum thinking someone just didn't understand the purpose of taxation. I'm disappointed that it wasn't that, since that might have been fun explaining, but at least you get, by the look of it.

And reading all that, I have no idea what all those forms mean. The socialist side of this country must be getting to me.

@cmpltnoob: Yeah. Taxes are no fun. lol

They're quite fun. Only take about 20-30 minutes on TurboTax and I got a sizable refund that allowed me to pick up an iPad :p.

I usually pay. When you got hired you filled out a W4 that amounts to how much money you want taken out from each paycheck in taxes and following their instructions amounts in a low number and you pay. Many people set that higher purposefully because they would rather get money back than have to come up with money to pay.

Make sure you send another check with the difference, as if the government doesn't have all you owe by April 15th it can fine you a bunch.

I also suggest doing your own forms. I make a decent amount, have no deductions, and just do basic math on the 1040EZ form every year for 15 minutes. Though when you are a poor college student there might be things like rent deduction and such which you'd never know about unless TurboTax asks you.

@daedelus: I actually earned less then $9750 and my mother has me as a dependent. Does that mean I don't have to file?

I was coming in to this forum thinking someone just didn't understand the purpose of taxation. I'm disappointed that it wasn't that, since that might have been fun explaining, but at least you get, by the look of it.

And reading all that, I have no idea what all those forms mean. The socialist side of this country must be getting to me.

I was expecting to see the same thing. Now I feel stupid because I see all these fucking form numbers and I can't make heads or tails of those, much less tax law in general.

Ahhh taxes .... the modern way governments use steal you more money

The only thing "modern" about taxes is the fact that you can do them on the computer now lol.

On one of my W-2's I have $0.51 Federal Income Tax withheld. Is that bad?

Thanks for the laugh.

@aegon: if you still live with your parents and only have one job it takes like a minute or two. The more complicated your life and where you get money the more you have to go through. All I have yo do is deducted some college textbooks. Hell nowadays you can just take a picture of your w2 and it will file that for you if your taxes really are that simple.

@acidbrandon18: hopefully this go around with taxes you'll realize it's smart to overcompensate with the amount you let get deducted from your paycheck. Personally I'd rather make a little less and get a nice check paying me back at the winter/spring than make more and realize I own the government money.

@daedelus: I actually earned less then $9750 and my mother has me as a dependent. Does that mean I don't have to file?

You should just get on TurboTax.com and start going through the process. It's free and will let you know if you even need to file or not.

@acidbrandon18: From the 1040EZ instructions:

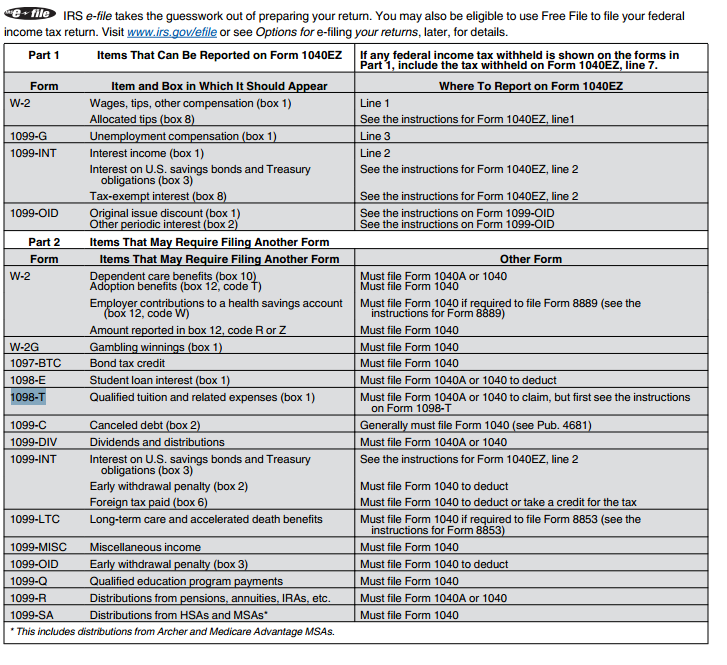

So since you are being claimed as a dependent the correct number is if you made under $5950 you don't have to file. The $9750 is if you are not claimed as dependent. If you do have to file you might have to use form 1040A because of the 1098-T form, but I am thinking you don't. I still think you can just use the 1040EZ next time as long as your situation is the same.

Basically gather all your forms then use the charts in the instructions to figure out which specific form you have to file. This explains what forms to use based on what you got in the mail:

The main reason you owe is that you work 2 different jobs. They each take out money that you would owe as if they were your sole job. The money coming out of each check is purely speculative that money you earned is what determines your tax bracket. The other job is doing the same thing. Problem is that them combined is throwing you into a different bracket and not enough money has been taken out of your checks.

Edit: I would also like to point out that the best scenario is that you don't get money back and you don't owe anything. Getting money back is because you paid the government too much and they got to make interest on your mistake. You owing is because you didn't pay enough. It is nice to get money back, but it's not free money; they are just giving you your money back.

@daedelus: This helps out alot. Thank you.

And thanks to everyone who has chipped in their two cents. I now have a slightly better understanding of taxes now.

Please Log In to post.

Log in to comment